Introduction

Blepharoplasty, another name for eyelid surgery, can be a life-altering procedure for people who have vision issues as a result of drooping eyelids. Although many people believe eyelid surgery is only cosmetic, if it is determined to be medically essential, insurance may pay it. Navigating the insurance approval procedure, however, can be challenging.

Your chances of being approved can be raised by being aware of the requirements, obtaining the required paperwork, and collaborating with qualified experts like myfastbroker insurance brokers. Everything you need to know, from qualifying requirements to successfully submitting a claim, will be covered in this tutorial. Continue reading for professional advice and doable actions to help speed up the process if you’re unsure how to get insurance to cover eyelid surgery.

Understanding Insurance Coverage for Eyelid Surgery

Insurance may pay for eyelid surgery, if it is medically required rather than cosmetic. When drooping eyelids result in vision impairment, persistent discomfort, or other functional problems, insurance companies usually grant reimbursement. You must provide medical records, such as vision exams and doctor evaluations, in order to be eligible.

You can get assistance navigating the approval procedure by working with professionals such as FastBroker Insurance Brokers. It’s critical to comprehend your policy and present the appropriate documentation because every insurance provider has different requirements. You can increase your chances of obtaining insurance that will pay for eyelid surgery by taking the right actions.

Medical vs. Cosmetic Eyelid Surgery: What’s Covered?

Eyelid surgery can be classified as medical or cosmetic, which determines whether insurance will cover it. Medical eyelid surgery is performed to correct vision impairment caused by sagging or droopy eyelids (ptosis). If a doctor confirms that excess skin obstructs vision, insurance may cover the procedure.

📌 Medical Eyelid Surgery ✅ Insurance May Cover It

🔻 Cosmetic Eyelid Surgery ❌ Insurance Won’t Cover It

- Purpose: Medical (Vision Improvement) vs. Cosmetic (Aesthetic Enhancement)

- Coverage: Requires Medical Necessity vs. Out-of-Pocket Expense

- Approval Process: Medical Documentation Required vs. Personal Choice

Eligibility Criteria: When Does Insurance Pay for Eyelid Surgery?

Insurance covers eyelid surgery only if it is deemed medically necessary. To qualify, patients must show that drooping eyelids (ptosis) obstruct vision, causing difficulty in daily activities like reading or driving. A comprehensive eye exam, visual field test, and medical documentation from a doctor are required.

Insurance providers, including FastBroker Insurance Brokers, assess these reports before approval. If the procedure is purely cosmetic, coverage is denied. Consulting with a specialist and submitting proper paperwork increases the chances of insurance approval.

How MyFastBroker Insurance Brokers Can Help with Coverage

It can be very difficult to navigate insurance claims for eyelid surgery, but MyFastBroker Insurance Brokers make it easier. They ensure you meet all coverage requirements by assisting in determining whether your operation is medically essential. Their professionals help you obtain crucial records to support your claim, like eye test results and physician suggestions.

In order to improve your chances of approval, MyFastBroker Insurance Brokers also bargain with insurance companies on your behalf. You can confidently obtain coverage for your eyelid surgery and steer clear of needless denials with their help.

FastBroker Insurance Brokers: Your Guide to Eyelid Surgery Claims

FastBroker Insurance Brokers makes the process of handling insurance claims for eyelid surgery easier. Their specialty is assisting clients in obtaining insurance approval for blepharoplasty and other medically essential operations. Their staff helps you obtain the coverage you are entitled to by collecting medical records, submitting claims, and contesting denials.

You can increase your chances of having insurance fund eyelid surgery by avoiding frequent errors thanks to their experience. FastBroker Insurance Brokers can help you navigate the insurance maze if you need advice.

Steps to Get Eyelid Surgery Covered by Insurance

Insurance coverage for eyelid surgery necessitates thorough preparation and paperwork. First, make an appointment for an eye examination with an ophthalmologist to determine whether your eyesight is affected by drooping eyelids. Request a comprehensive medical report and visual field test results if required by the doctor. Then, to find out what your policy covers, speak with FastBroker Insurance Brokers or MyFastBroker Insurance Brokers. Send in a request for pre-authorization together with the required paperwork. File an appeal with more medical evidence if it is rejected. The likelihood that your insurer will approve eyelid surgery increases if you follow these measures.

Choosing the Right Surgeon: Why It Matters for Insurance Approval

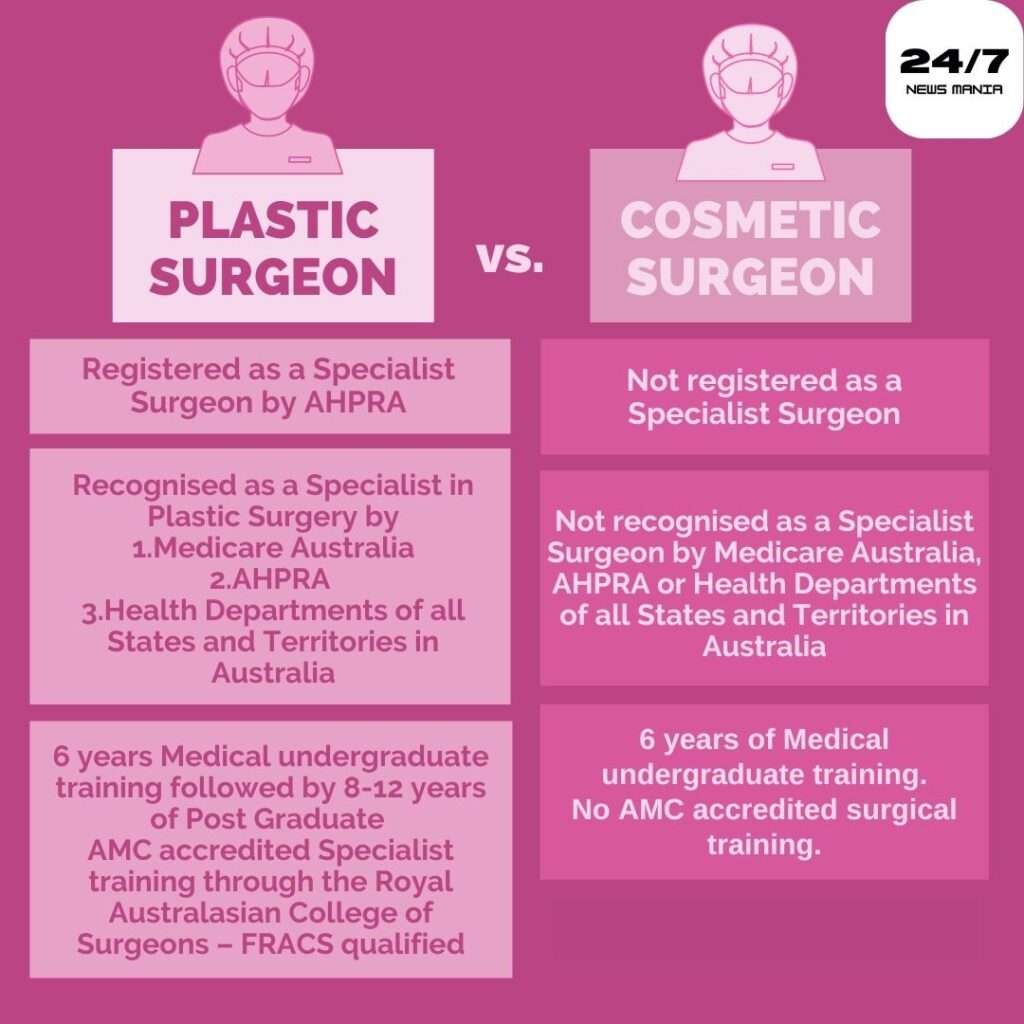

Selecting the right surgeon is crucial when seeking insurance approval for eyelid surgery. A qualified surgeon, preferably an ophthalmologist or plastic surgeon specializing in functional blepharoplasty, can provide the necessary medical documentation to prove that the procedure is medically necessary.

Insurance companies require detailed reports, visual field tests, and photographs to justify coverage. A reputable surgeon understands these requirements and can help navigate the approval process. Working with experienced professionals and consulting MyFastBroker Insurance Brokers or FastBroker Insurance Brokers can further increase your chances of approval. Choosing an expert ensures both a successful procedure and a smoother insurance claim process.

Success Stories: People Who Got Eyelid Surgery Covered by Insurance

Eyelid surgery, or blepharoplasty, can be covered by insurance when deemed medically necessary. For example, a patient experienced decreased peripheral vision due to droopy upper eyelids. After medical evaluation, his upper blepharoplasty was covered by insurance, while the lower eyelid procedure, performed for cosmetic reasons, was not.

Another patient, Pam, struggled with droopy eyelids affecting her vision and appearance. After a visual field test confirmed the impairment, her upper eyelid surgery was approved by insurance. She also chose to have her lower eyelids done for cosmetic reasons, which were not covered. Post-surgery, she felt rejuvenated and regained confidence.

These cases highlight that insurance coverage for eyelid surgery hinges on demonstrating medical necessity, particularly when vision is impaired.

Summary

Eyelid surgery can be covered by insurance if deemed medically necessary, such as for vision impairment. Understanding the difference between medical and cosmetic procedures, obtaining proper documentation, and working with MyFastBroker Insurance Brokers or FastBroker Insurance Brokers can improve approval chances. Success stories show that proof of vision obstruction is key

Leave a Reply